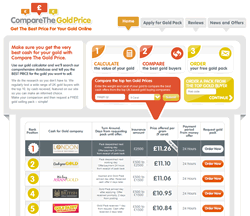

The top five companies listed on this comparison site are all affiliated to the site itself.

A price comparison website is supposed to give you honest and impartial information to help you locate the best deal, right? No so with with gold buying comparison sites.

A recent BBC programme discovered the site they investigated was rigged and listed prices from companies they were affiliated with. Our own detective work has revealed other so-called ‘comparison sites’ can’t be trusted.

The BBC investigation, broadcast on Radio Four’s ‘You and Yours’ programme, followed a number of complaints about the service and deals offered by scrap gold companies on the gold buying comparison website, www.compare-the-gold-price.com.

False promise and low prices

The company highlighted in the investigation and one of ten then appearing on the compare-the-gold-price.com website was www.cash-for-gold.co.uk. On their own site, cash-for-gold.co.uk promise “more per gram than any other gold buyer”.

However, all the programme’s participants received offers from cash-for-gold.co.uk that were significantly lower than they expected, and often lower than the cash-for-gold.co.uk’s online gold calculator said they’d receive. In one case, broadcast on the Radio Four programme, cash-for-gold.co.uk only offered £845 for gold items that were actually worth £2,200.

All the participants had found cash-for-gold.co.uk listed as one of the ‘top ten’ gold buying companies on compare-the-gold-price.com. They’d chosen cash-for-gold.co.uk as, at the time, it offered the highest price on the site.

Rigged and artificial prices

Listen to the BBC Radio 4 You & Yours investigation into gold price comparison websites

However, as the BBC’s investigative journalist discovered, the top listed gold buying companies listed on the compare-the-gold-price.com were all run by, or connected to the same individuals. This meant the comparisons were artificially rigged, and a scam.

Additionally, the prices per gram shown on the comparison website hadn’t changed for several months, despite the actual price of gold fluctuating on a daily basis.

Our own investigations have also confirmed that the owners of compare-the-gold-price.com are also connected or affiliated to the following websites:

- The British Gold Refinery – britishgoldrefinery.co.uk

- The London Gold Refinery – londongoldrefinery.co.uk

- We Buy Asian Gold – webuyasiangold.com

- Cash Your Gold – cash-your-gold.co.uk

- Daddy Cash for Gold – daddycashforgold.co.uk

- Best Price for Silver – bestpriceforsilver.co.uk

Incidentally, the British Gold Refinery – (britishgoldrefinery.co.uk) – has recently been rapped by the Advertising Standards Authority for running misleading pricing information on their website, has been slammed by the BBC TV’s Ripoff Britain programme for dishonest trading and is also is the subject of a Facebook campaign by disgruntled former customers, calling for the company to be closed down.

Unauthorised activities

To give the site a veneer of credibility, compare-the-gold-price.com also listed a price from H. Samuel – a well-known High Street jeweller, and a name the BBC’s callers recognised and trusted. They said that because H. Samuel was on the site, they felt the comparisons would be valid. In fact, H. Samuel was horrified when the BBC contacted them; the company hadn’t given its permission to be on the site, and in fact hadn’t provided an online gold buying service for over a year. The price couldn’t possibly be genuine and was obviously a fabrication intended to make the other gold buyers look more attractive.

Not to be trusted

H. Samuel’s spokesman said the company would refer the matter to their legal department. Interestingly, H. Samuel no longer appears on compare-the-gold-price.com’s website, which now quotes a price from Tesco Gold Exchange. Again, this is presumably without permission, as the price per gram shown on the comparison site is not what Tesco Gold Exchange is actually offering (at the time of writing this article).

Appalling service

It wasn’t only the prices received from cash-for-gold.co.uk that gave the Radio Four You and Yours callers cause for concern. In each case, they’d had to threaten legal action either to get a price, or to get their gold returned. One caller admitted she accepted what she knew was a very poor price from cash-for-gold.co.uk, because she feared she’d never get her gold back at all. And remember, the other top three companies on this so-called comparison website were connected with cash-for-gold.co.uk – so you could expect a similarly poor response from them.

The comparison scam

Our own researches have shown this problem isn’t isolated to compare-the-gold-price.com. If you dig deeper, you’ll find most of the gold buying comparison sites are either affiliated to, or receive income from those sites it lists. For example, the comparison site comparethegoldprice.co.uk lists goldrefiners.co.uk as their top paying company. Not surprising when you discover those two sites are connected!

Unregulated websites

Gold buying comparison websites purport to offer a fair and transparent comparison of the prices different companies will pay, as we’re used to seeing with insurance comparison websites. However, insurance comparison sites are regulated by the Financial Conduct Authority, but there’s no control at all over the gold buying comparison sites.

Poorer prices, guaranteed

Another point to note is that the gold buying companies appearing on similar comparison sites generally pay commission for referrals. That’s typically £20 – £30 per referral, which goes to the comparison site owner and is inevitably deducted from the amount they’re prepared to pay you for your gold.

How to find a better price

So what’s the answer? Quite simply, if you don’t want to be scammed, or you want to achieve a fair price for your gold, don’t bother with gold buying comparison sites. Bullion dealers, such as Gold-Traders (UK) Ltd don’t appear on any comparison site because:

- We’re independent

- We don’t pay affiliate referral fees (as they would result in lower payments to our customers).

In short, you’ll be rewarded with a better price and a higher standard of service than you could ever expect from a comparison site.